This is a category of innovation based on user needs.Ĭonvex Finance: Improving the user experienceĬonvex, which officially launched on May 17 of this year, surpassed Yearn as the platform with the highest percentage of CRVs locked on June 3 2021.Ĭonvex aims to improve on Curve in terms of user experience by launching a one-stop platform for CRV pledging and liquidity mining. This is because these collateral assets increase in value. Looking at Abracadabra as a whole, in addition to improving the utilisation of funds, it also reduces the likelihood of liquidation. Only independent liquidation risk, no linkage with other collateral Stablecoin MIM has good liquidity on the multi-chain Curve Low borrowing costs and stable interest rates Unlike MakerDAO, the assets pledged by Abracadabra are assets with proceeds, and users can use interest-bearing tokens, such as yvUSDT and xSUSHI, to borrow or mint a dollar-pegged stablecoin called MIM (Magic Internet Money) on Abracadabra, thereby freeing up such assets liquidity and increase user revenue.Ĭonvert already interest-bearing asset certificates into liquidity to increase capital leverage and earn more income Olympus DAO changes its relationship with the liquidity provider, turning the traditional DeFi liquidity model on its head.Ībracadabra: Adding value to assets and improving capital utilizationĪbracadabra is a lending platform with a protocol incentive token – SPELL – which has a similar model to MakerDAO in that it over collateralised assets to generate stablecoins. In addition, it is the protocol itself, not the user, that owns the LP tokens, thereby generating transaction fees from the liquidity pool while preventing immediate selling pressure from the liquidity provider. Olympus DAO: LP Token Status (as of November 3, 2021) MakerDAO, one of the largest decentralised applications (dApp) on the Ethereum blockchain, is the platform to generate the first decentralised stablecoin DAI. Curve, which occupies nearly one-third of the total TVL market share of DEXs, provides exchange services focused on stablecoins using an upgraded AMM formula. Many DeFi 1.0 projects demonstrated the powerful disruptive ability of decentralized finance.

The core of DeFi 2.0 is to add liquidity into the infrastructure layer, making the development of the industry more sustainable.

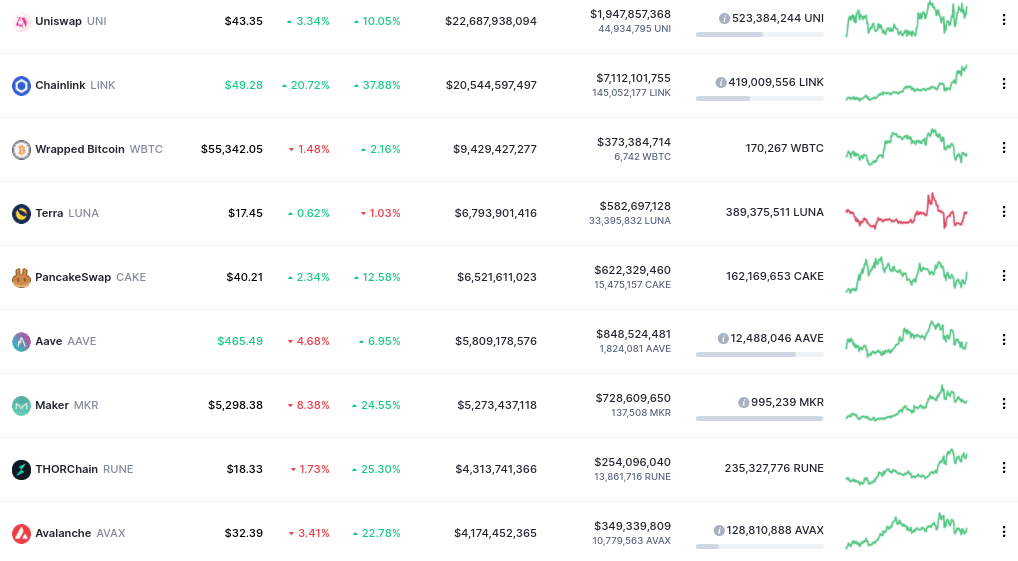

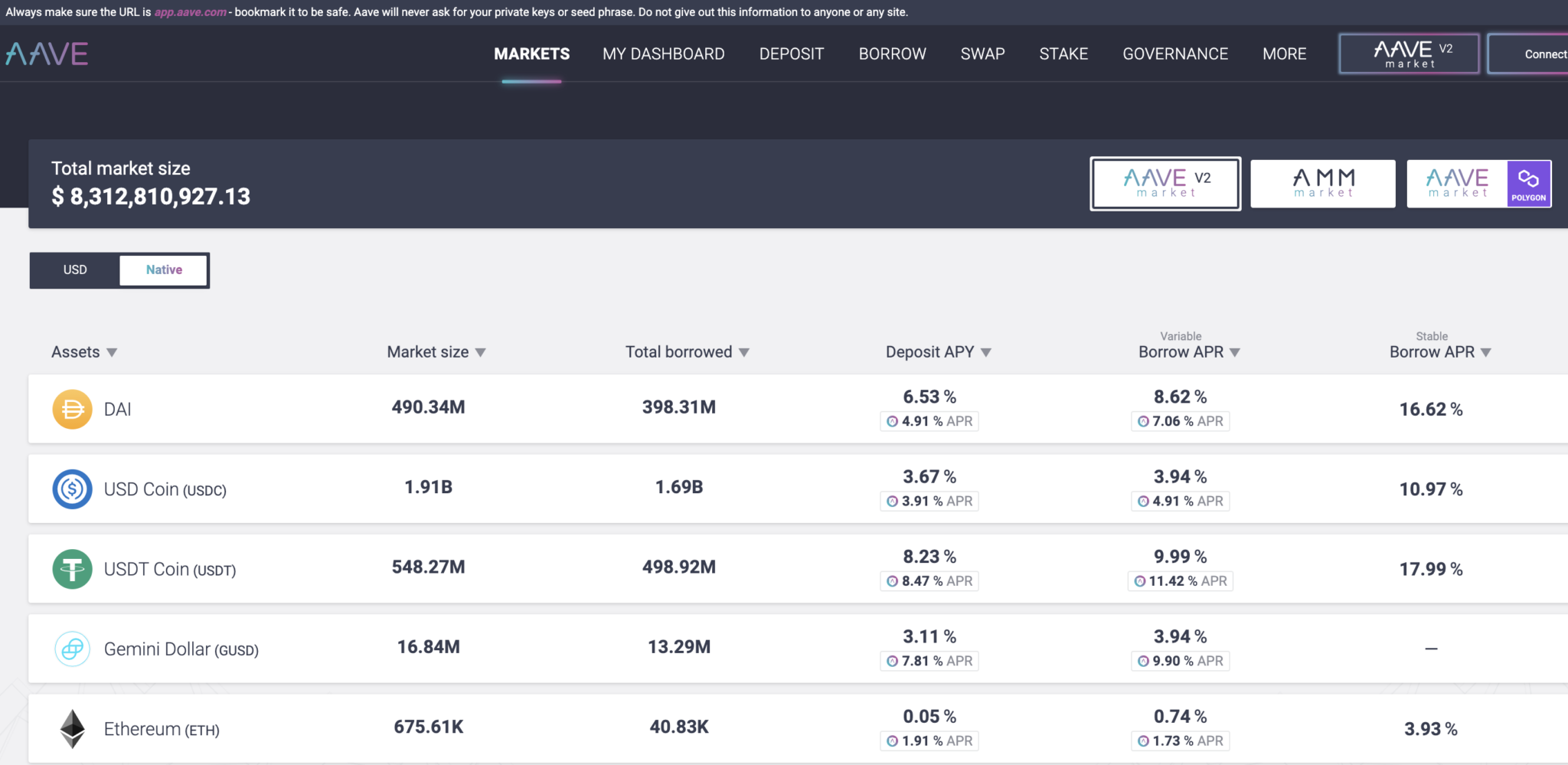

Insurance-type projects (Cover, Nexus Mutual)ĭeFi 2.0 refers to a layer of applications built upon the first generation of the protocol. Liquidity machine gun pool applications (Yearn) It includes:ĭecentralised central trading applications and DEXs (Uniswap, SushiSwap) What do they do? What problems will DeFi 2.0 solve? Are these projects sound investments? What is DeFi 2.0ĭeFi 1.0 is the early decentralized financial infrastructure that constitutes the current DeFi ecosystem. Whereas DeFi 1.0 gave people liquidity mining, token exchanges, lending, and AMMs, DeFi 2.0 promises to improve the user experience, introduce new finance technologies, and improve capital utilisation.Īmong the most important projects likely to headline the next generation of DeFi are: Footprint Analytics: DeFi TVL(since January 2019)

0 kommentar(er)

0 kommentar(er)